Key Takeaways: STKESOL Launch – Liquid Staking & Solana DeFi with Loopscale

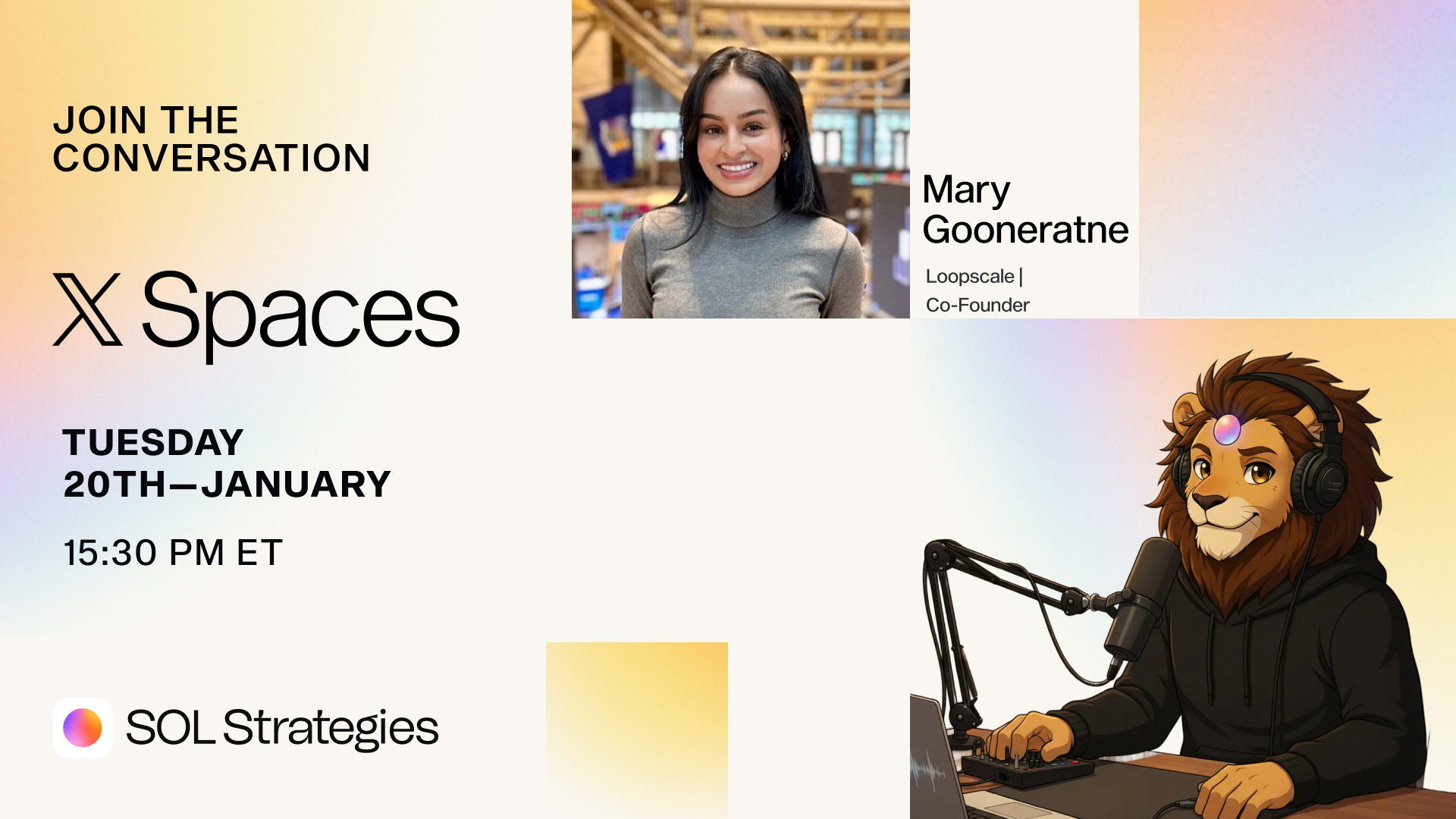

Yesterday, SOL Strategies marked the launch of its liquid staking token, STKESOL, alongside an in-depth discussion led by Interim CEO Michael Hubbard and CTO Max Kaplan with special guest, Loopscale Co-Founder Mary Gooneratne. The conversation explored liquid staking, DeFi lending, and the growing importance of yield-bearing assets in Solana’s financial infrastructure, positioning LSTs as a […]

Yesterday, SOL Strategies marked the launch of its liquid staking token, STKESOL, alongside an in-depth discussion led by Interim CEO Michael Hubbard and CTO Max Kaplan with special guest, Loopscale Co-Founder Mary Gooneratne. The conversation explored liquid staking, DeFi lending, and the growing importance of yield-bearing assets in Solana’s financial infrastructure, positioning LSTs as a foundational building block for on-chain capital markets.

Strengthening Solana Through Liquid Staking

The conversation opened with the motivation behind launching STKESOL. Michael explained that the objective was to support the health of the Solana network by strengthening its validator set. At launch, STKESOL had over 540,000 SOL delegated across 75 validators, contributing to decentralization and network security.

Max reinforced this network-first design:

“We launched STKESOL for the betterment of the Solana network. A strong validator set is what’s best for Solana, and that’s what we’re all about.”

By distributing stake broadly rather than concentrating it among a small group of operators, liquid staking plays a role in maintaining Solana’s resilience as the network grows in usage and complexity.

Why LSTs Are Tax and Capital Efficient

Michael outlined how liquid staking tokens operate and why they have become a core Solana primitive. Instead of receiving incremental staking rewards each epoch, LST holders experience appreciation in the token’s value as rewards accrue to the underlying stake.

This structure can offer tax efficiency, depending on jurisdiction. As Michael noted:

“With an LST, you can have one token, 10 tokens, or 100 tokens, but the number doesn’t change; the value changes. So you have a capital gain of entry or short term capital gain depending on how long you hold it, so there is tax efficiency with LSTs. That’s a big use case.”

Beyond taxation, LSTs enable capital efficiency by allowing users to borrow against staked SOL. This structure provides access to liquidity without requiring the sale of the underlying asset, preserving long-term exposure while unlocking utility.

LSTs as a Core DeFi Collateral Asset

Mary shared that LSTs represent one of the fastest growing asset classes on Loopscale. Their predictable yield profile, grounding in Solana’s staking system, and liquidity characteristics make them well suited for borrowing and lending use cases.

A common application involves leveraging yield rather than price. Through looping products, users amplify staking returns by borrowing against LST collateral in a streamlined, one-click experience, while maintaining manageable risk due to the close correlation between SOL and its liquid staking derivatives.

From Speculation to Yield and Fixed Income

Mary pointed to a broader shift within crypto markets:

“There’s more of a focus on yield-bearing instruments and fixed income products as opposed to purely price speculation, which is a really cool sign of the maturing of crypto and DeFi.”

On Loopscale, this shift has corresponded with increased demand for fixed-rate borrowing, structured products, and yield-focused strategies that remain relevant across varying market conditions.

Lending as DeFi’s Bridge Into Traditional Finance

Mary also discussed lending as a key area of differentiation for DeFi relative to traditional finance:

“A lot of the product differentiation that is yet to exist and can actually create that first wedge into traditional finance, is largely in the lending sector.”

She explained that many inefficiencies in traditional credit markets stem from operational constraints. As she described:

“If you think about things that make credit issuance high friction in TradFi, such as collateral management and servicing that drive up the cost of credit and limit issuance, they are solved very well by having a composable open ledger with programmable assets.”

The Road Ahead for Solana DeFi

The discussion concluded by summarizing the key themes explored throughout the conversation. The combination of liquid staking, DeFi lending, and yield-bearing assets illustrates how Solana’s financial layer functions beyond speculative activity, emphasizing infrastructure, capital efficiency, and network fundamentals.

Together, STKESOL and platforms like Loopscale demonstrate how Solana supports a full-stack on-chain financial system built on strong network fundamentals and increasingly sophisticated capital markets.

Disclaimer

- No Investment Advice or Offer: The information provided here is for general informational purposes only. It does not constitute an offer to sell or a solicitation of an offer to buy any securities, futures, options, or other financial instruments. This information is not investment, legal, or tax advice and should not be considered an individualized recommendation or personalized advice. Any decisions based on this information are your sole responsibility.

- Opinions, Accuracy, and Liability: Views expressed are as of the date indicated, are subject to change without notice, and may not reflect the views of SOL Strategies. Certain statements may be based on SOL Strategies’ views, estimates, or opinions, which may not be accurate or ultimately realized. Information obtained from third-party sources has not been independently verified, and SOL Strategies does not assume responsibility for its accuracy. SOL Strategies nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees, or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of this information. SOL Strategies expressly disclaims any and all liability relating to or resulting from the use of this information.

- Company Disclosures & Conflicts: SOL Strategies and its affiliates may own investments or have other incentives in some of the digital assets, protocols, and securities discussed herein. SOL Strategies does not provide services as a money transmitter, custodian, bank, securities broker-dealer, investment adviser, or commodity trading adviser and is not registered as such with the U.S. Securities and Exchange Commission, the U.S. Commodity Futures Trading Commission, or other regulatory agencies.

- Important Risk Warnings: Past performance is no guarantee of future results, and examples are for illustrative purposes only. All investments carry risk. Digital asset investments are high-risk and subject to, among other things, price volatility, regulatory changes, and cyber-attacks. Cryptocurrencies are not legal tender, not backed by any government, can become illiquid, and may result in the total loss of principal. On-chain transactions are irreversible. These investments are only for investors with a high-risk tolerance.

- Forward-Looking Statements: The information provided herein may contain “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is based on certain factors and assumptions believed to be reasonable at the time such statements are made and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned against attributing undue certainty to forward-looking statements.